Despite the recent turmoil in the cryptocurrency markets, 2023 crypto investor sentiment is back to being relatively positive and optimistic, with most survey respondents around the globe saying they are bullish on crypto, especially long term. While many expressed concerns about crypto market volatility, regulatory concerns and rug pulls, on the whole most people had optimistic attitudes about the future of crypto.

Here’s a round up of recent surveys and key article snippets highlighting crypto investor sentiment and attitudes in 2023 and beyond:

BitcoinIRA survey shows optimism among crypto investors. BitcoinIRA, a self-directed individual retirement account (IRA) platform, conducted a survey on investor sentiment towards cryptocurrencies and found that despite the recent downturn in the price of bitcoin (BTC), investors remain bullish on crypto.

2023 Independent Reserve Cryptocurrency Index shows Singaporeans are still actively investing in crypto despite hit in overall confidence:

- Singapore scored 55 out of 100, indicating a hit to respondents’ confidence in cryptocurrency

- 44% hold at least 10% of crypto in their portfolio; 40% are likely to invest in the next 12 months

- Deep-dive into attitudes toward cryptocurrency across three new segments this year: Female Investors, High-income Earners, and Young Adults

- 44% hold at least 10% of cryptocurrency in their portfolio

- 47% have been investing in cryptocurrency for 1-2 years

- About half of Singaporeans, 46%, invest up to $1,000 / month on cryptocurrency

Crypto Market Sentiment In America

Americans are a bit less enthusiastic and or confident that cryptocurrency is safe or effective to use (right now) for financial transactions. According to a recent Pew Research poll:

- Overall, 17% of U.S. adults say they have ever invested in, traded or used a cryptocurrency.

- 75% of Americans aren’t confident in the safety and reliability of cryptocurrency

- Roughly one-in-five cryptocurrency users say the investments have hurt their personal finances at least a little

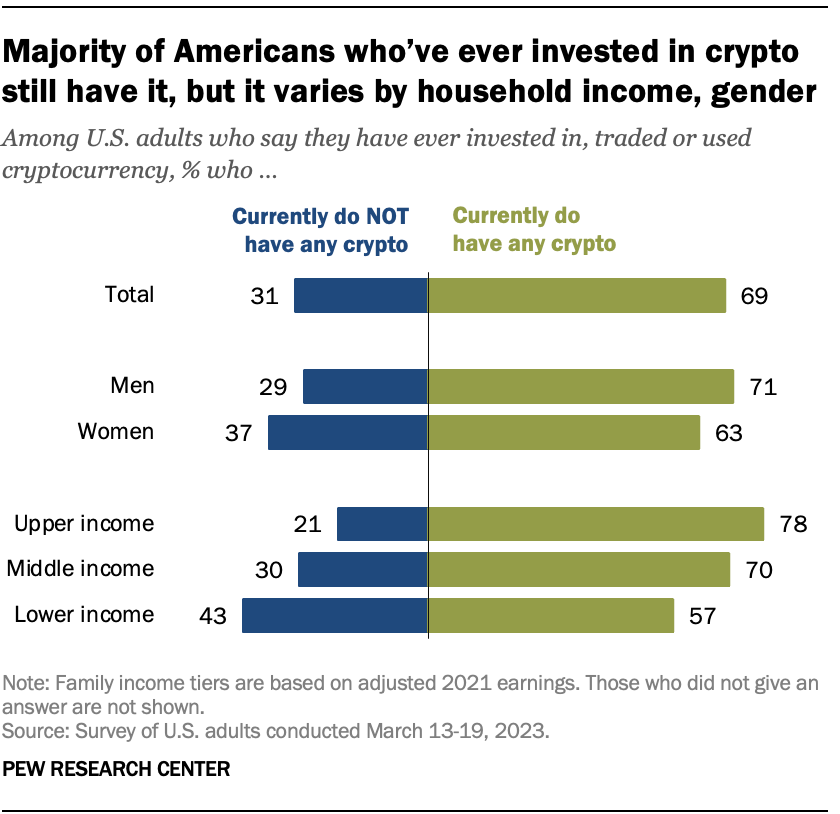

- Roughly three-in-ten adults (31%) who have ever invested in, traded or used cryptocurrency say they currently do not have any cryptocurrency. Still, a majority (69%) say they do currently have cryptocurrency.

The Aspen Institute Financial Security Program conducted 10 in-depth interviews with economically, racially and geographically diverse research respondents from November 10 – December 5, 2022:

- Most research participants view cryptocurrency as a high-reward investment with high risk

- Participants see cryptocurrency as one aspect of a diverse portfolio of investments

- Cryptocurrency appeals to participants for its ease of use and as a more accessible alternative to traditional finance for investors of color

- Research participants consider themselves above-average risk takers

- They see themselves as participating in a new, decentralized system that will provide societal benefits

According to a survey of 30,000 adults in 20 countries recently released by Gemini:

- 2021 Was Crypto’s Breakout Year: Forty-one percent of crypto owners surveyed globally purchased crypto for the first time in 2021. More than half of crypto owners in Brazil (51%), Hong Kong (51%), and India (54%) got started in 2021. Globally, 41% of respondents said they are crypto-curious. The crypto-curious are defined as consumers who do not currently own crypto, but are either interested in learning more or say they are likely to acquire cryptocurrency in the next year.

- The Crypto Gender Gap May Be Narrowing: Among the crypto curious who plan to purchase crypto for the first time in the next year, 47% were women globally. Among crypto owners, women in developing nations led the way with women representing at least half of crypto owners in Israel (51%), Indonesia (51%), and Nigeria (50%). Conversely, in developed countries and regions only a third (33%) of current crypto owners are women, including in the United States (32%), Europe (33%), and Australia (27%).

- Inflation a Primary Driver for Crypto Adoption: Respondents in countries that have experienced 50% or more devaluation of their currency against the USD over the last 10 years were more than 5 times as likely to say they plan to purchase crypto in the coming year**, including South Africa (32%), Mexico (32%), India (40%), and Brazil (45%). In Brazil, where the local currency has been devalued by more than 200% against the USD, 41% of respondents own crypto. In the U.S., two in five (40%) crypto owners see crypto as a hedge against inflation.

- Crypto Regulation A Top Concern Globally: Regulation is a concern globally. Among non-owners, 39% in Asia Pacific, 37% in Latin America, and 36% in Europe say there is legal uncertainty around cryptocurrency. In addition, for 30% of respondents in the Middle East, 24% in Asia Pacific, and 23% in Latin America, the tax complexities of owning cryptocurrency have kept them from investing in crypto.

- Education is the Greatest Barrier to Ownership: Globally, respondents were nearly twice as likely to say that more educational resources on cryptocurrency would help them get started with crypto (40%), compared to recommendations from friends (22%). More than half of respondents in Latin America (51%) and Africa (56%) said that educational resources would make them more comfortable purchasing cryptocurrency. Forty-four percent in Asia Pacific and 42% of those in the United States said the same.

Crypto Market Predictions For 2023 Onward: Positive But Cautious

Of course we don’t know exactly what is going to happen with cryptocurrency markets in 2023, 2024, 2025 and beyond. Taking current signals and data into consideration and factoring in sentiment, adoption trends and other factors, things look promising for crypto investors. Sentiment and investor attitudes are generally positive but cautious. Still, there are many unanswered questions and a lot of potential headwinds and opportunities developing. By keeping up-to-date on a few important indicators and trends in crypto, you will be able to make more informed investment decisions as the market continues to grow and evolve. The bottom line? Crypto IS the future of money. Nearly everyone agrees on that prediction. ~