The crypto markets are constantly evolving and traders are always looking for new ways to stay ahead of the curve. One metric that has been gaining attention in recent months is the supply of stablecoins on exchanges. Stablecoins like Tether USDT and USD Coin USDC are cryptocurrencies that are pegged to a fiat currency, such as the US dollar. This makes them a popular choice for traders who want to avoid the volatility of other cryptocurrencies.

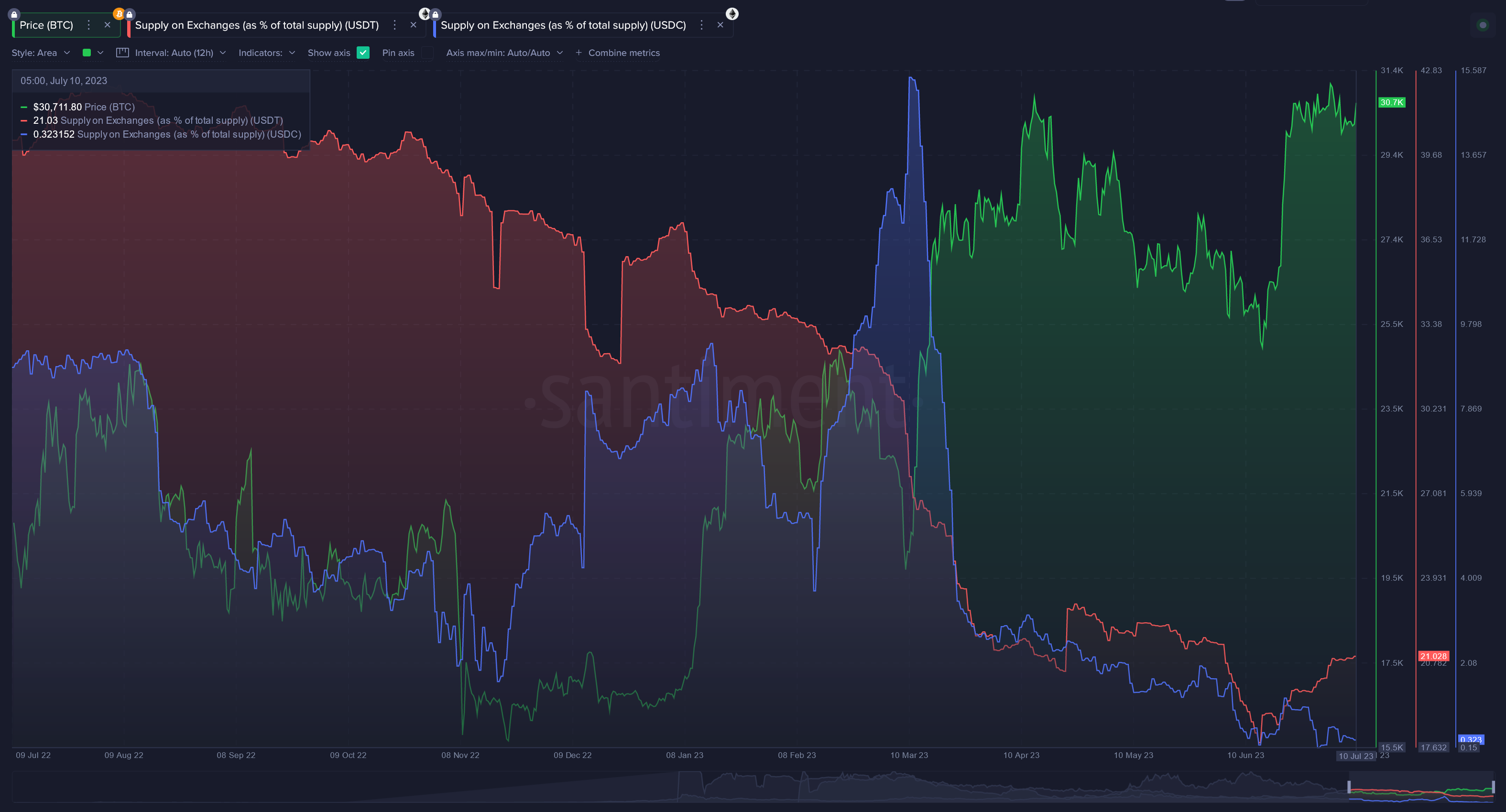

A new analysis by the analytics firm Santiment suggests that the supply of stablecoins on exchanges can be a leading indicator of price movements in the crypto markets. The analysis found that a rapid rise in the supply of stablecoins on exchanges could precede an increase in crypto prices.

This metric may be useful for traders who are looking to identify potential buy opportunities in the crypto markets. By monitoring the supply of stablecoins on exchanges, traders can get an early indication of when the market is becoming bullish.

Here are some additional details from the stablecoin analysis:

- The two most popular stablecoins by market cap are Tether (USDT) and US Dollar Coin (USDC).

- The supply of stablecoins on exchanges can be tracked using a variety of tools, such as the Santiment Pulse Index.

- The new analysis found that the supply of stablecoins on exchanges has been rising in recent weeks.

- This increase in supply in Whale wallets and exchanges could be a sign that traders are becoming more confident in the crypto markets.

- If the trend continues, it could lead to a surge in crypto prices in the near future.

“Especially when USDT and USDC supplies are being moved rapidly to exchanges, as we saw with USDC in March right before the market-wide price surges.”

The analytics firm also notes that traders should pay attention to whether the top 10 largest USDT and USDC addresses are adding stablecoins.

Additionally, Santiment suggests that traders monitor the mean dollar invested age of Tether and USDC. The mean dollar invested age is the average age of all tokens on the blockchain weighted by the purchase price.

“Mean dollar invested age is what we would call a ‘validator’ metric. When the curve of this line begins moving down, it’s indicating that any upswing in crypto markets is being validated by dormant coins moving to push up prices even further in the future.

And in the case of stablecoins, movement of older coins that had been stagnantly sitting in wallets is generally a very good sign.”

Generated Image: Midjourney