-

New Bitcoin analysis predicts slow, consistent price increases ahead.

-

Current BTC price as of this writing is 30,205.60 USD 1:35 PM UTC.

-

New analysis from two of the top cryptocurrency analytics firms is supplying guarded optimism to many investors today. Can bitcoin break through and stick past it’s current resistance at 30,000 USD?

According to the market analytics platform CryptoQuant, 1,000 to 10,000 BTC unspent transaction output (UTXO) Value Bands have been gradually rising since December 2022.

Expanding bitcoin’s UTXO value along with firm prices might suggest that 2022 was a long-term bottom.

A UTXO is the leftover of a crypto transaction that outlines the behavior of investors, especially whales. According to CryptoQuant, “1K-10K UTXO Value Bands are known to be the most trendy indicator according to its price.”

Moreover, the upsurge in the 1,000 to 10,000 BTC UTXO Value Bands in 2023 is quite similar to 2019, when the bitcoin price swung from $4,000, reaching to as high as $61,500 in April 2021. The rally preceded a fall when asset prices, including bitcoin’s, crashed in 2022.

Glassnode data shows that the number of coins held in self-custody or lost wallets is at 7,781,224 BTC, marking a five-year high.

This development comes as the crypto scene was rejuvenated by the recent judgement that saw Ripple win against the US Securities and Exchange Commission (SEC) and the regulator finally accepting recent spot BTC ETF applications.

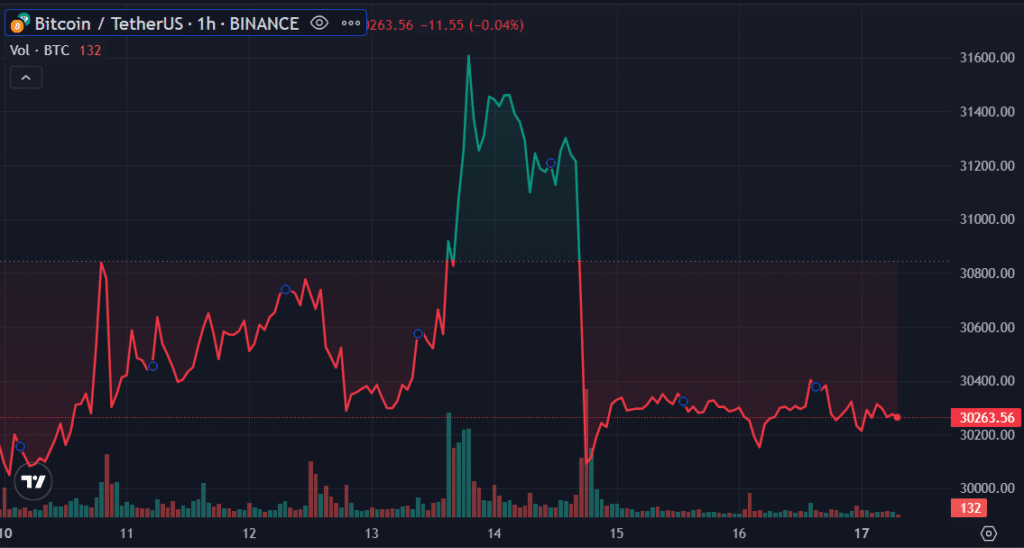

Bitcoin has been consolidating between $30,200 and $30,400 over the past two days and is down by 0.05% in the last 24 hours. The coin is trading at $30,275 at the time of writing with rising 24-hour trading volume — up by 2.22% to $8.2 billion.

However, the asset is still down by 4.83% from its local top of $31,814 registered on July 13.

What is a UTXO in Bitcoin? How does a UTXO transaction work?

The UTXO model serves as the foundation for Bitcoin and other cryptocurrencies that have been inspired by its design. In this model, every transaction consists of inputs and outputs. The inputs refer to the Unspent Transaction Outputs (UTXOs) that are being used for spending, while the outputs represent the newly created UTXOs. When a transaction is initiated, the sender must provide sufficient UTXOs as inputs to cover the value of the transaction. As a result, the receiver of the transaction receives these new UTXOs as outputs.

The UTXO model offers numerous advantages. Firstly, it is straightforward to comprehend and put into practice. Secondly, it proves highly efficient in terms of storage and bandwidth usage. Thirdly, it enhances security by making double-spending UTXOs a challenging task.

Nevertheless, there are certain drawbacks associated with the UTXO model as well. To begin with, it can be challenging to trace the ownership of small amounts of cryptocurrency. Additionally, creating intricate transactions, such as those involving smart contracts, can also pose difficulties in this model.

What is the account model of Ethereum? What is the difference between UTXO and account model?

The Account model is utilized by cryptocurrencies like Ethereum and EOS. In this model, every user possesses an account that keeps track of their balance. When a transaction is initiated, the sender’s account balance is reduced, while the receiver’s account balance is increased.

The Account model has advantages over the UTXO model in terms of tracking ownership of small amounts of cryptocurrency and creating complex transactions. However, it is less efficient in terms of storage and bandwidth, and it is not as secure as the UTXO model.

Account Model Advantages:

- Easy to track ownership of small amounts of cryptocurrency. The Account model tracks the ownership of cryptocurrency by assigning each user an account. This makes it easy to track the ownership of small amounts of cryptocurrency, as users do not need to track individual UTXOs.

- Easy to create complex transactions. The Account model can easily create complex transactions, such as those that involve smart contracts. This is because the Account model does not need to track individual UTXOs.

Account Model Disadvantages:

- Less efficient in terms of storage and bandwidth. The Account model requires more storage and bandwidth than the UTXO model, as it needs to store the account balances of all users.

- Not as secure as the UTXO model. The Account model is not as secure as the UTXO model, as it is more vulnerable to double-spending attacks. This is because the Account model does not require users to spend all of the UTXOs in their account when they create a transaction.

Ultimately, the best model for a cryptocurrency depends on its specific needs. If a cryptocurrency needs to be easy to use and create complex transactions, then the Account model is a good choice. However, if a cryptocurrency needs to be secure and efficient, then the UTXO model is a better choice.