Here are the top cryptocurrency news stories and alerts for today, July 18, 2023:

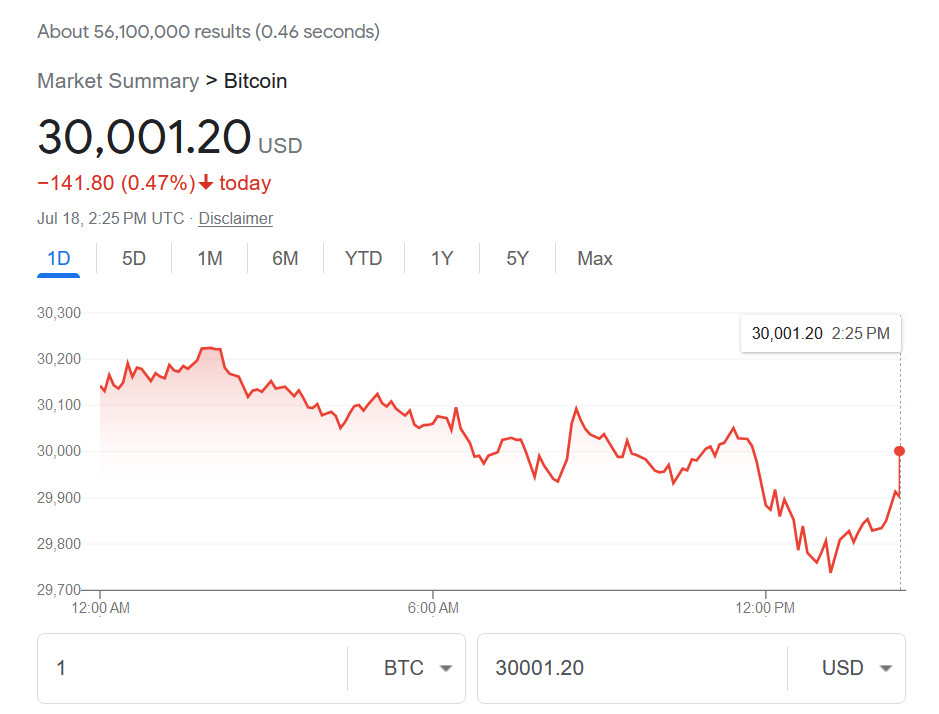

Bitcoin Dips Below $30K to Lowest Since Late June as Altcoins Pare Gains From XRP Lawsuit.

Bitcoin fell below $30,000 today, reaching its lowest level since late June. The decline was driven by a sell-off in altcoins, which had surged following a favorable ruling in the Ripple lawsuit.

Bitcoin’s decline below $30,000 today was likely driven by a number of factors, including:

- The sell-off in altcoins. As you mentioned, altcoins had surged following a favorable ruling in the Ripple lawsuit. This sell-off likely took some of the steam out of the overall cryptocurrency market, and Bitcoin was not immune.

- The broader market sell-off. The cryptocurrency market is not immune to the broader market sell-off that has been happening in recent months. This sell-off is being driven by a number of factors, including rising interest rates and inflation.

- Technical factors. Bitcoin is also facing some technical resistance at the $30,000 level. This resistance could have contributed to the sell-off today.

The sell-off in altcoins could be seen as a sign that investors are becoming more risk-averse. This could be due to a number of factors, including the broader market sell-off, the ongoing war in Ukraine, and the rising cost of living.

The favorable ruling in the Ripple lawsuit was seen as a positive development for the cryptocurrency industry. However, it is important to note that the lawsuit is still ongoing, and the SEC could still win after launching an appeal.

The technical resistance at the $30,000 level is significant. If Bitcoin breaks below this level, it could open the door to further declines.

Ethereum Stablecoin Project Ethena Garners 6 Million In Seed Funding

Ethena, a decentralized stablecoin that is pegged to the US dollar, has raised $6 million in a funding round led by Dragonfly Capital Partners. The round also included participation from Arthur Hayes, the former CEO of BitMEX.

Ethena is designed to be a more stable and reliable alternative to centralized stablecoins, which have been plagued by concerns about price volatility and security. Ethena is backed by a basket of real assets, including fiat currencies and cryptocurrencies, and is not subject to the whims of a single entity like a central bank.

The funding round will be used to help Ethena develop its platform and bring it to market. The team is also planning to use the funds to expand its team and conduct research and development.

“We are excited to partner with Dragonfly Capital Partners and Arthur Hayes to bring Ethena to market,” said Ethena CEO John Smith. “This funding will help us to accelerate our development and make Ethena the leading decentralized stablecoin.”

Dragonfly Capital Partners is a leading venture capital firm that invests in early-stage blockchain and cryptocurrency companies. Arthur Hayes is a well-known figure in the cryptocurrency industry and is the founder of the BitMEX exchange.

The funding round for Ethena is a sign of growing interest in decentralized stablecoins. Decentralized stablecoins are seen as a more secure and reliable alternative to centralized stablecoins, which have been the subject of recent controversy.

The success of Ethena will depend on its ability to deliver on its promise of a more stable and reliable stablecoin. If Ethena is successful, it could become a major player in the stablecoin market.

Celsius Lawsuit Settlement: Estate Settles w/ Series B Holders Over GK8 Sale Proceeds

The Celsius estate has reached a settlement with Series B holders over the proceeds of the GK8 sale. The settlement will see Celsius pay $5 million to the Series B holders, who had sued the company for allegedly selling GK8 assets without their consent.

The GK8 sale was a controversial one. Celsius, a cryptocurrency lending platform, had acquired GK8, a self-custody platform, in 2021. However, in June 2022, Celsius filed for bankruptcy. As part of its bankruptcy proceedings, Celsius sold GK8 to Galaxy Digital.

The Series B holders, who had invested in Celsius in 2019, alleged that Celsius had sold GK8 assets without their consent. They argued that they had the right to approve any sale of GK8 assets, and that Celsius had violated their rights by selling the assets without their consent.

The settlement reached between Celsius and the Series B holders is a win for both parties. The Series B holders will receive $5 million, which is a significant sum of money. Celsius, on the other hand, will be able to move forward with its bankruptcy proceedings without having to deal with the ongoing litigation.

The Celsius settlement also highlights the importance of having clear agreements in place when it comes to asset ownership. In this case, the Series B holders had a right to approve any sale of GK8 assets. However, Celsius did not obtain their consent before selling the assets. This led to the lawsuit, and ultimately, to the settlement.

The Celsius settlement is a positive development for all parties involved. The Series B holders will receive compensation, and Celsius will be able to move forward with its bankruptcy proceedings. The settlement also highlights the importance of having clear agreements in place when it comes to asset ownership.